workers comp taxes for employers

Workers compensation for an occupational sickness or injury if paid under a workers compensation act or similar law. Each employers premium is based on rates for different job categories that are multiplied by.

What Wages Are Subject To Workers Comp Hourly Inc

Whether you pay Ohio BWC KEMI or popular private carriers like Travelers or Liberty Mutual one thing that is common across the board for work comp insurance is that your insurance premium looks more like a payroll tax then an insurance bill.

. Payment is due by the last day of the month following the end of the quarter. Yes workers comp payments and benefits that employers pay to their employees are deductible business expenses. However you can also claim a tax credit of up to 54 a max of 378.

Business owners are able to deduct the costs of required insurance payments from their tax liability if they are necessary for their business operations. However retirement plan benefits are taxable if either of these apply. You are not subject to claiming workers comp on taxes because you need not pay tax on income from a workers compensation act or statute for an occupational injury or sickness.

Do you claim workers comp on taxes the answer is no. Once you come to the end of your year policy your final workers comp rate can be adjusted to account for initial over- or under-estimated payroll projections. The employer must obtain a workers compensation insurance policy.

The following payments are not taxable. The fee for covered employees working on the last day of the quarter is 200. Once you have the estimated annual payroll for the employee divide that number by 100.

The standard FUTA tax rate is 6 so your max contribution per employee could be 420. 1099 workers comp protects business owners from liabilities when it comes to injured or ill employees. Ad Filing your taxes just became easier.

8 hours agoThe general answer is no. A 20000 payroll with a workers compensation rate of 016 would cost just 32 per year. If you also receive SSDI with your workers compensation youll pay taxes on the SSDI like usual.

This cost is included in Box 1 and in Box 12 of the W-2 as one of the options. However business owners can deduct their workers compensation taxes or payments to cover insurance premiums. Savvy employers often cut costs by not employing employees but hiring independent contractors instead.

You then multiply that number by the premium rate for the class code to find the total cost of. Dealing with a work injury can be stressful not only because youre hurt but dealing with your employer and the. Most employers pay both a federal and a state unemployment tax.

This is based upon the highest 39 paid weeks out of the last 52 before the workplace accident occurred. We want to be your workers compensation agency. By law you can only receive up to 80 of your pre-injury earnings between SSDI and workers comp benefits.

Over 85 million taxes filed with TaxAct. Moreover an experienced workers compensation attorney may be able to structure your workers comp settlement in a way that minimizes the offset and reduces your taxable income. Up to 25 cash back 7031 Koll Center Pkwy Pleasanton CA 94566.

Common expenses include travel office equipment and supplies and phone and internet services. Read on for the answer. The coverage can however be costly especially for small businesses with limited budgets.

Thus while a portion of your workers comp may considered taxable income in practice the taxes paid on workers comp are usually small or non-existent. It is not withheld from the employees wages. When an employee suffers an illness or injury on the job it is the responsibility of the employer to provide workers compensation a public federally funded benefit that assists the employee.

The Workers Compensation Program processes claims and monitors the payment of benefits to injured private-sector employees in the District of Columbia. If youve received workers comp over the previous tax year you might be wondering whether youll owe taxes on them. Well review your current workforce and recommend best options for coverage.

Checks are paid on a weekly basis and. The fee for the employer is 230 times the number of covered employees working on the last day of the quarter. When implementing work-from-home policies employers should consider the tax aspects of paying or reimbursing business expenses for remote workers.

Workers compensation settlements and weekly payments are not subject to income taxes. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. This leaves you with a total estimated payroll of 2016 or 1008 per employee.

Disputes between claimants and employers or their insurance carriers are mediated and employers are monitored to ensure compliance with insurance coverage requirements. The amount paid should equal 80 of an employees after-tax average weekly wage including overtime and discontinued fringe benefits. But life insurance costs paid by your company of over 50000 are taxable to employees.

You dont have to pay taxes on weekly checks under workers comp. According to the federal tax code detailed by the IRS incidental insurance. Since workers compensation benefits are not taxable the Internal Revenue Service does not allow taxpayers to deduct their awards.

Start filing for free online now. The Federal Unemployment Tax Act FUTA with state unemployment systems provides for payments of the unemployment compensation to workers who have lost their jobs. Then multiply it by the class code rate of 144.

Educational assistance benefits under 5250 paid to employees in a. In that sense workers comp is in the same. If you have any questions regarding the employees work requirements please contact employees manager at telephone.

Benefits provided to the employees of California by the states workers compensation insurance program are not taxable. 8810 is 016 and well round their salary to 20000. It doesnt matter if your settlement is in a lump sum or structured to pay benefits over a period of time.

Only the employer pays FUTA tax. Start your workmans compensation insurance quote online or give us a call today at 888-611-7467. The cost of up to 50000 of life insurance provided to employees isnt included in their income.

File your taxes stress-free online with TaxAct. Questions pertaining to Internal Revenue Service workers compensation issues may be directed to our Workers Compensation Center located in Richmond Virginia at 1-800-234-8323. But do independent contractors need to have 1099.

Workers compensation benefits are payable to individuals who have suffered a work-related injury or illness. Compensating remote workers for business expenses. Employers can typically claim the full.

Take caution not to directly supervise 1099 workers as that could qualify them as an employee. The IRS manual reads. The clerical workers rate NCCI code.

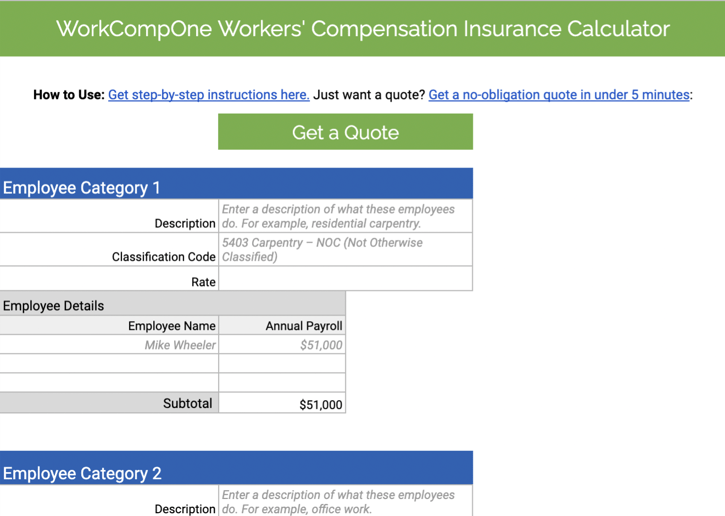

How To Calculate Workers Compensation Cost Per Employee Pie Insurance

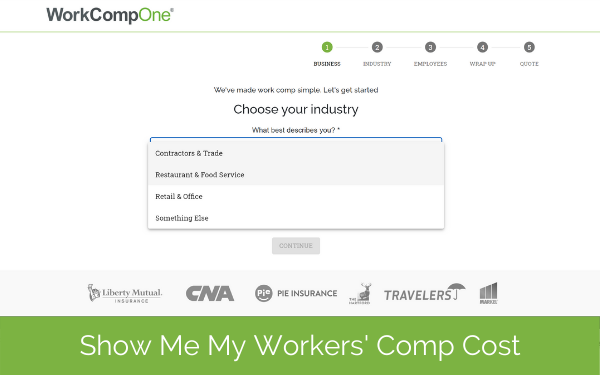

Workers Compensation Insurance Cost Calculator How Much For A Small Business Policy

How A Worker S Comp Settlement Is Calculated Bdt Law Firm

How To Calculate Workers Compensation Cost Per Employee

How To Understand Workers Comp Codes In Louisiana Canal Hr

Permanent Disability Pay In California Workers Comp Cases 2022

Is Workers Comp Taxable Workers Comp Taxes

Workers Compensation Insurance Overview Amtrust Financial

The Workers Compensation Notice Employers Resource

Costratesadvisor Com Payroll Analysis Report Workers Comp Insurance Analysis Payroll Taxes

Workers Compensation And Taxes Phalenlawfirm Com Ks And Molaw Office Of Will Phalen

Fmla Vs Workers Compensation Rules What No One Tells You

Texas Workers Compensation Laws Costs Providers

Are Workers Comp Benefits Adequate Legal Talk Network

Is Workers Comp Taxable Hourly Inc

Is My Workers Comp Taxable Ksa Insurance

Ncci State Map State Map Small Business Insurance Map

When Does Workers Comp Start Paying After A Workplace Injury